In response to the increase in commercial real estate leasing vacancy in downtown Portland, the city has adopted the “Downtown Business Incentive (DBI)” temporary non-refundable credit program to incentivize new commercial lease signings and existing lease renewals in certain downtown Portland districts, which will be taken against the Portland Business License tax. We wanted to provide you with some basic facts regarding the credit so that you can decide if this could be included in your future plans.

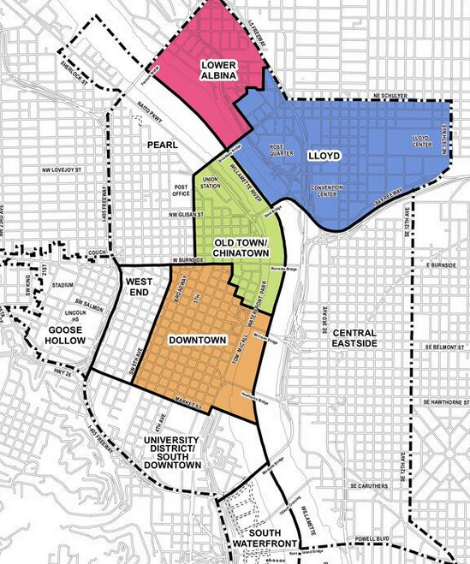

The districts that this apply to are shown below:

- Lower Albina

- Lloyd

- Old Town/Chinatown

- Downtown

The single-use credit is non-refundable and applied over four years, starting in either tax year 2023 or 2024, to any business that is registered and up to date with the City of Portland Revenue Division. The business must enter a new lease, extend an existing lease, or own and occupy a building space within the eligible sub-district boundaries, during the 2023 or 2024 calendar year, and for a period of four years or more. Lastly, the business must maintain 15 or more full-time employees (including family members) working at least half their time in the building space during this time.

The credit is limited to the lesser of 1% of the City of Portland “Income Subject to Tax”, or $30 per square foot of applicable building space, and is limited to $250,000. It is calculated based on the “year of origination” (or the year that the application and approval is based on), divided in 4, and applied over four years. If a lease is broken during this time, then the credit must be repaid including interest. The due date for applying for tax year 2023 is January 31, 2024, and January 31, 2025 for tax year 2024. You can apply online, by mail, or in person and approval will be granted within 45 days.

If you think that your business will qualify for the credit, you can apply at the link below:

https://www.portland.gov/revenue/apply-downtown-business-incentive-credit

We hope this helps!